September 16, 2024

Real estate recession finally ending. Get ahead of the herd.

In the last 20 years, I cannot remember a time that three institutions had such a remarkable impact on the residential real estate industry. The impact has distracted real estate professionals, buyers, and sellers. We look to one institution to make a move this week.

A softening of 25 bps in the Federal Reserve System’s fund rate is widely anticipated this week, and an oversized movement of 50 bps is speculated. The Fed cuts do not translate exactly to mortgage rates, they directionally signal a lower cost to borrowing and, at first, a modest increase in buyers' purchasing power. Continued softening in the Fed’s fund rate will be very stimulating to the housing market.

This movement to the downside will trigger the “herd” of buyers on the sidelines waiting for the rate cut. The cut will also stimulate the refinance market for those who originated mortgages in the past 18 to 24 months.

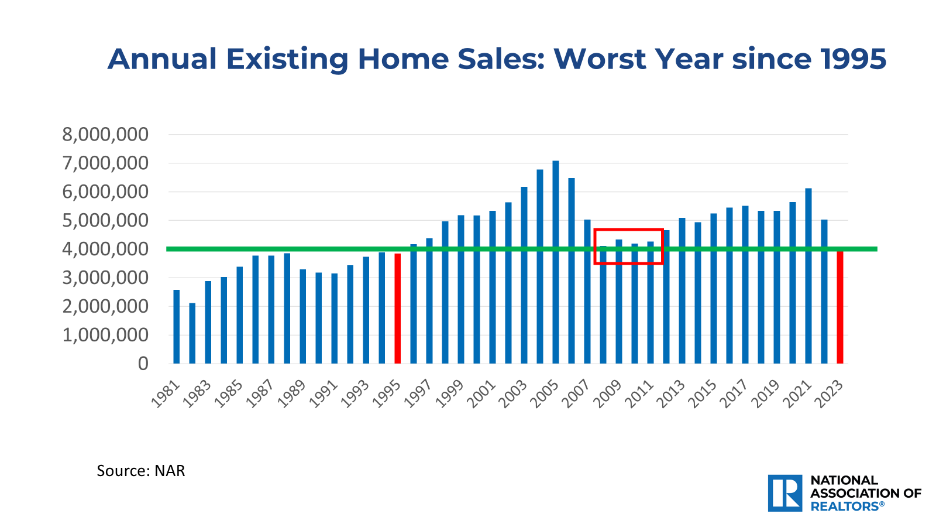

This could be the beginning of a steady, multi-year run of increasing existing home sales in the United States. We have not experienced the current seasonally adjusted existing home sales rate or sub-4 million since 1995.

The long steady run-up in units sold from both 1995 to 2005 and from 2010 to 2021 represent strong 10-year runs.

Jumbo mortgage rates could very well have a “5-handle” (5X%) heading into the coming market this fall. We have not seen mortgage rates with a 5-handle since September 2022, on their way up to a high peaking at over 8% in October 2023.

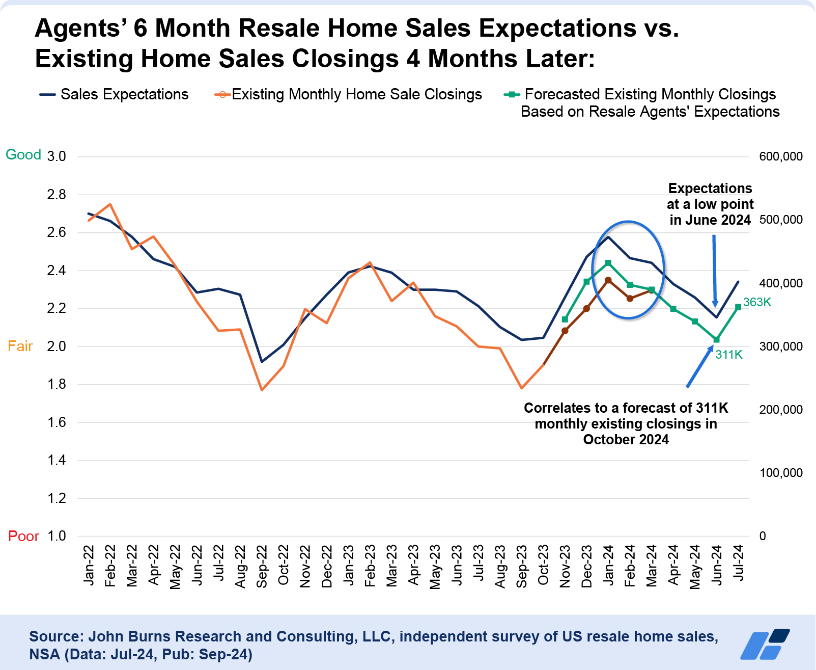

A recent JBREC survey of over 1,000 real estate agents suggests that the fall selling season could peak in November with seasonally adjusted home sales at around 4.3 million – consistent with NAR’s expectations. This will result in a welcome flurry of buying activity starting now.

Multi-year Run

If history repeats itself, we could be in for a multi-year positive run in the residential real estate markets. My outlook is positive, and I am coaching to this message!

Here we go! Get ahead of the herd.

This is Where We Are Now!

Thanks!

Mark

Sign up to join the blog and be notified of updates.