August 5, 2024

Opportunity Knocks: Timing Strategies

When to Buy a New Home?

Last week we received easing direction from the Fed and significant volatility in the equity markets driven by weakening employment and inflation moving toward 2%. Consumers are once again whiplashed with economic news. What should home buyers be considering on the timing of a purchase decision?

Over the weekend, I spoke with the CEOs of my two favorite mortgage companies, James Elliott, CEO, OriginPoint and Luca Dalhausen, CEO, Realfinity. I was looking for advice for a homebuyer on when to buy. The easy answer might be “wait until the Fed moves” and benefit from lower interest rates.

The best answer might be act now and save thousands of dollars on the purchase of your home!

A few observations:

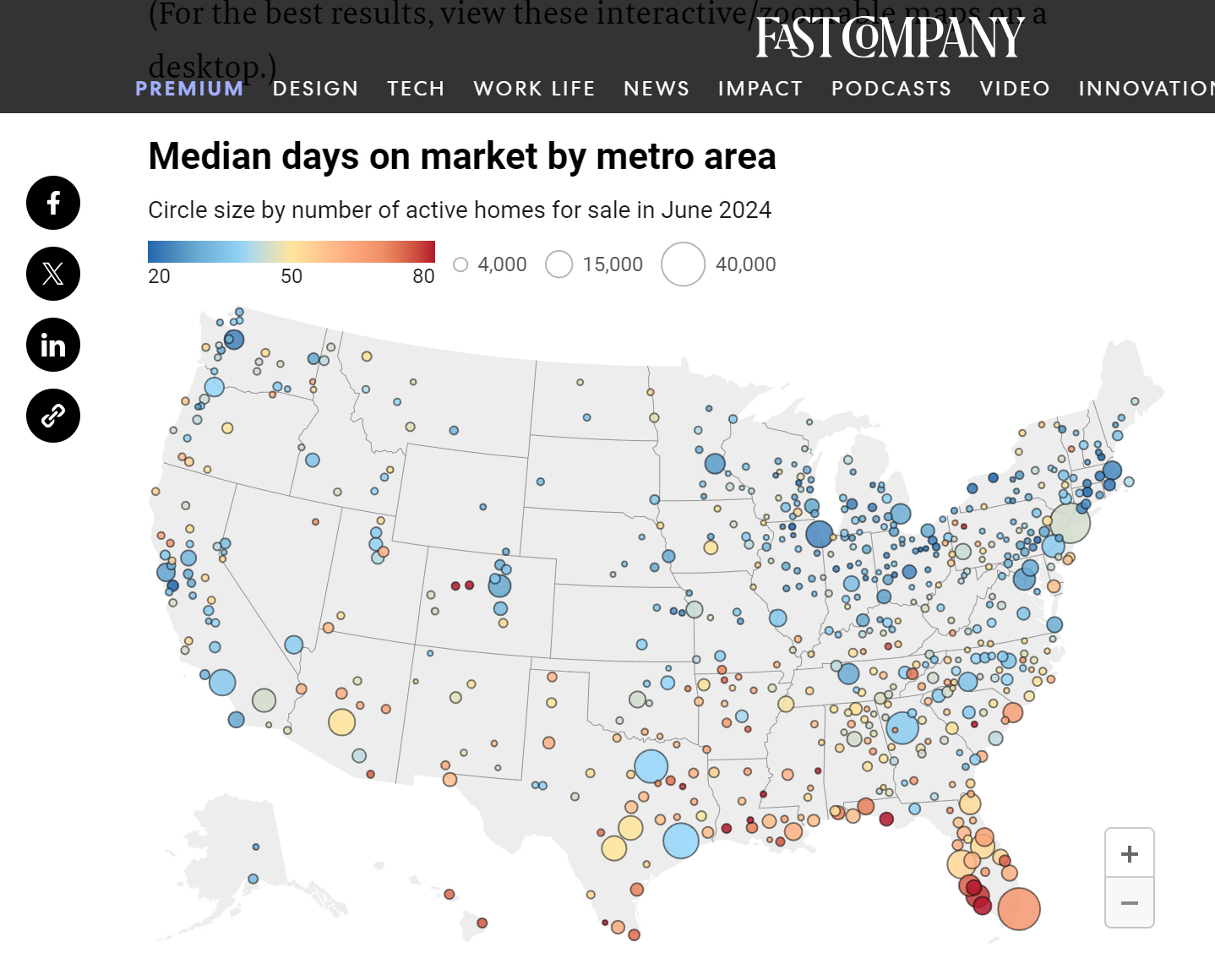

- Inventory was building in June 2024 and is even higher today, especially in the Southwest and Southeast.

- Rising inventory and increasing DOM (days on market) generally translate to softening home prices.

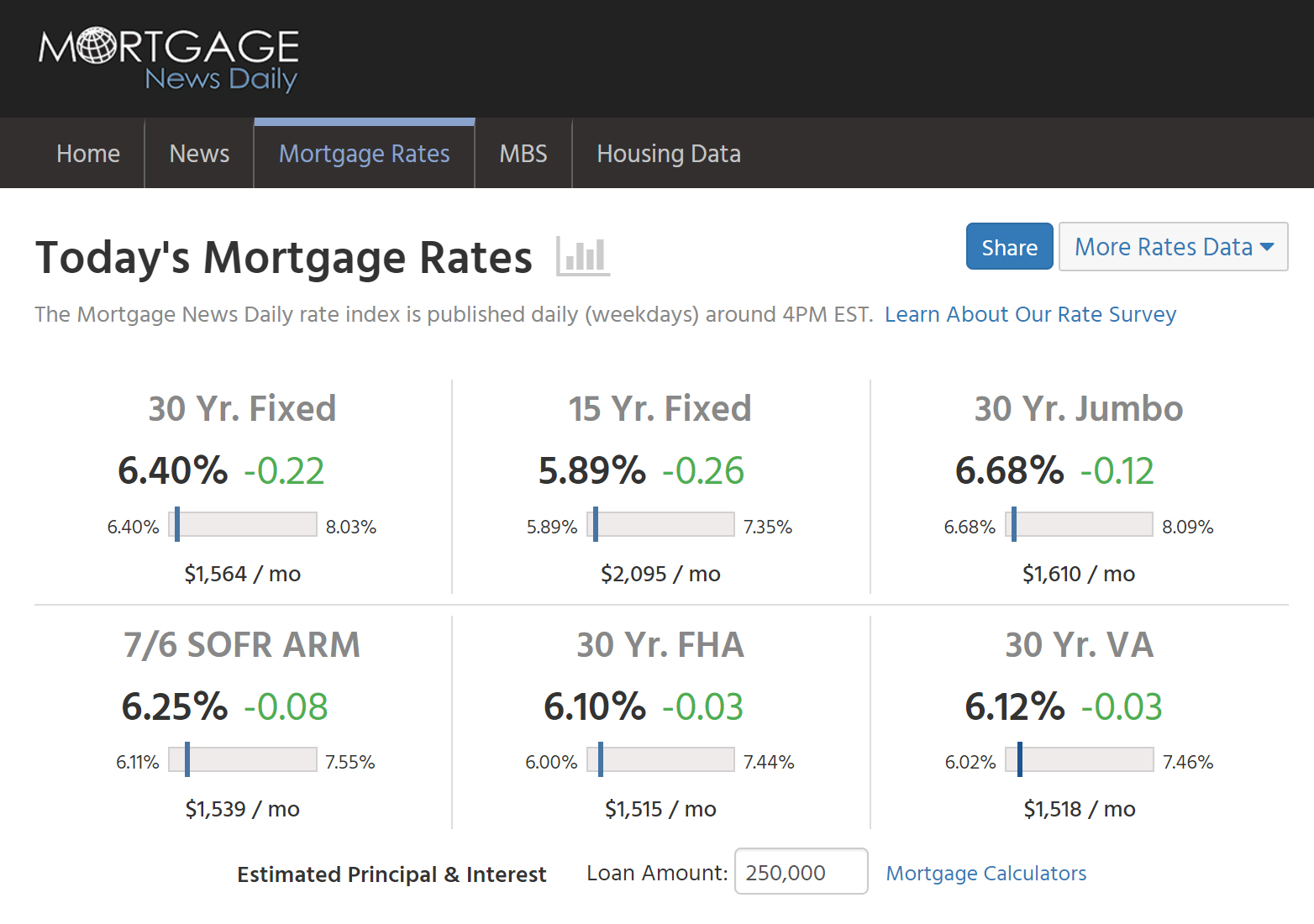

- Use an example of buying a $2 million home. If you move now, you may save 5% or $100,000 on the purchase price. Use $20,000 to buy down the interest rate on a $1 million mortgage. This could bring down your mortgage rate by 0.50% to 0.75%. This is the equivalent of the deepest prediction of what the Fed may do by year-end.

- The Fed’s move to lower rates will stimulate pent-up housing demand, that has been sidelined, to return to the market. This demand will cause prices to firm or increase.

Buying down the 30 year fixed mortgage illustrated below would give you a mortgage between 5.70% to 5.90%. When did you think you would next see a 5% handle on a mortgage?

Your best timing on a home purchase is right now. I am experienced at “buying at the bottom” of a cycle. Fifteen years ago yesterday, I purchased Pacific Union at the bottom of the Great Financial Crisis. Today our housing market is at the bottom (units sold) trending at a June 2024 seasonally adjusted rate of 3.89 million homes sold – slower than actuals from 2023.

Don’t follow the herd – execute on your dream home now!

By the way – Compass announced Q2 ’24 earnings last week – we are proud of the team’s effort.

Thanks!

Mark

Sign up to join the blog and be notified of updates.