May 28, 2025

Our industry can’t price a home: The importance of price discovery

Last month I was included on the stage at Inman Miami. Thank you to Brad, Emily, and Karyn. I was in the company of Brad as moderator, plus James Dwiggins of NextHome Inc. and Christina Pappas of The Keyes Company. A balanced group and a quick 30-minute conversation.

My opening comment was “There is one group missing in this conversation [on this stage] and that is the consumer or home seller.”

Compass and others believe in seller choice. Compass Three Phase Marketing is their execution strategy.

EXP and others say they believe in MLS only. Most of these MLS-only firms also have “private exclusives.”

Zillow & RedFin have announced that they will exclude public listings of more than 24 hours public marketing if they are not on MLS.

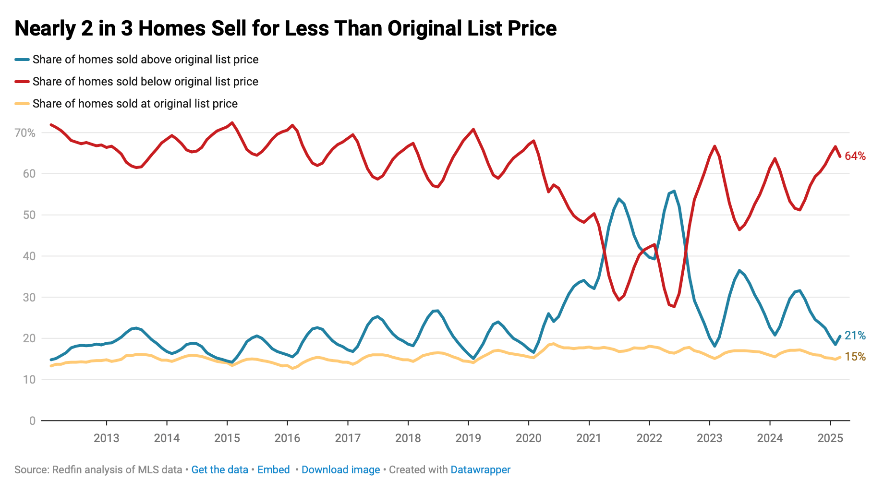

Most Listings Sell Below Original List Price

The fact is our industry struggles with the appropriate pricing of a new listing.

According to RedFin, referencing analysis of MLS data, excluding COVID years:

- ~64 percent of all listings sell below the original list price.

- ~15 percent sell at the list price.

- ~21 percent sell for over asking.

It seems that “price discovery” has a strategic role in our industry.

Compass is operating by the rules of NAR CCP, and local MLS. Compass’ Three Phase Marketing execution is very attractive to sellers. Compass’ execution skills are exceptional – many industry players are consumed with analyzing Compass’ point of view and execution vs. running their own businesses.

- 94 percent of Compass listings make it to the MLS – within the local rules.

- Of the 6 percent that do not make it to the MLS, more than half are co-brokered.

- In Q1 2025, ~ 10 percent of Compass Private Exclusives or Coming Soons that don’t make it to the MLS sell for more than $2 million.

According to RealTrends data for 2024, EXP’s average sales price (ASP) is around $450,000, which is in line with the ASP in the United States.

In comparison, Compass’ ASP in 2024 was $1.1 million, and ~ 10 percent of the brokerage’s Q1 2025 closings exceeded $2 million in sales price.

The needs of a Compass client, especially over $2 million, are very different than the needs of the average U.S. home seller at $450,000. Over $2 million demands discretion, privacy, confidentiality, creativity and more that may not be necessary at $450,000.

Our Industry Clearly Needs a More Accurate Way to Price a Home

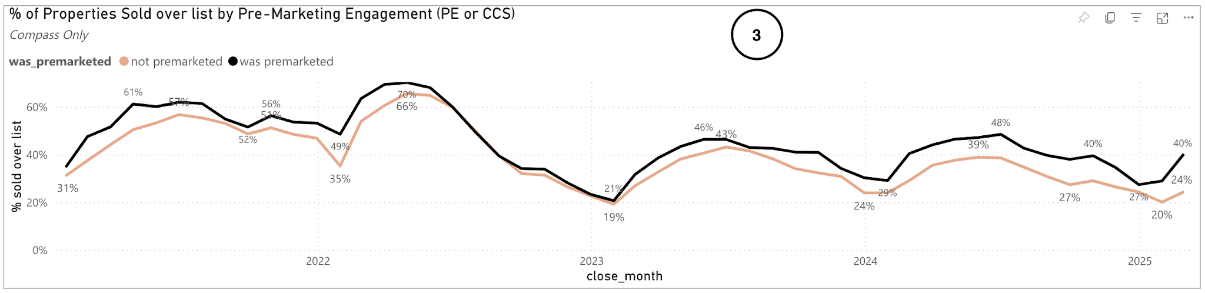

Compass Three Phase Marketing Program, and its price discovery, is exactly that. Around 40 percent of Compass homes that are pre-marketed sell for more than their list price. Twice the industry results reflected in the graph above.

And for those of you on the “steering campaign,” the financial penalties imposed on real estate professionals that do not list on the MLS is absolutely a form of steering.

Like Goldman Sachs vs E-Trade – there can be different execution strategies in the same industry. Ultimately, clients choose!

This is “Where We Are Now!”

Thanks!

Mark

Sign up to join the blog and be notified of updates.